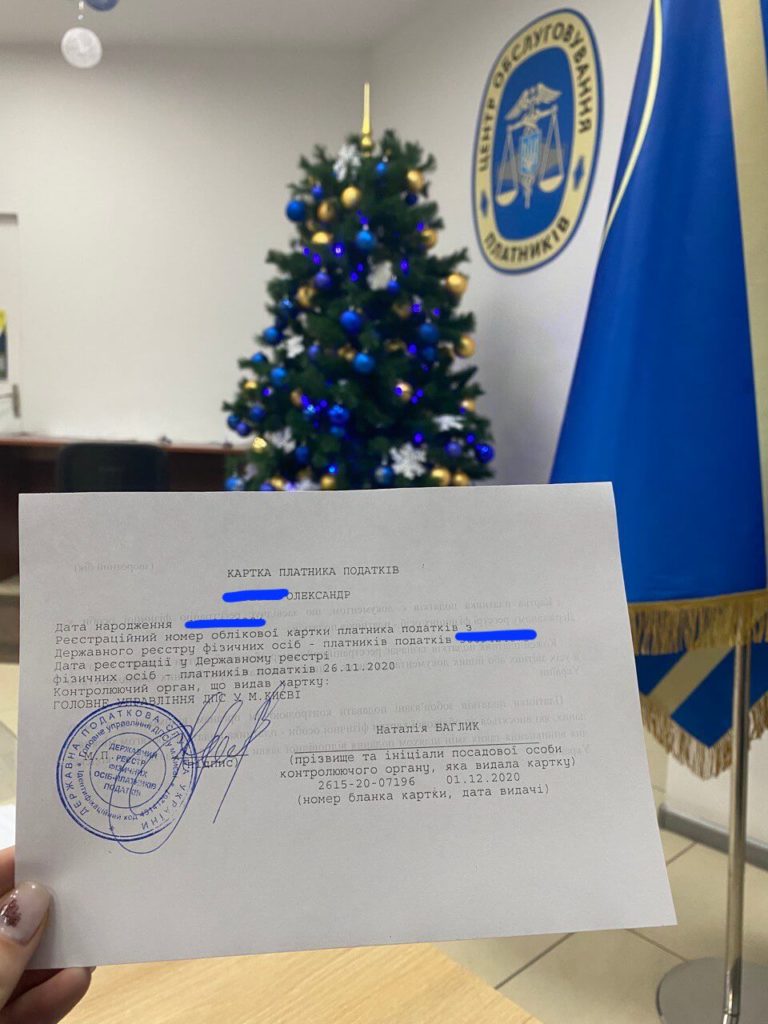

Tax number is necessary for any financial transactions in Ukraine.

Without a tax number you will not be able to buy a real estate, register a business, open a bank account, to be vaccinated, etc.

How to get a tax number if you don’t have a temporary residence permit?

To begin with, you need to submit the documents to the Main Department of the State Tax Service. In each region you can apply in the main regional department and in Kyiv in the main city department of the Tax Service of Ukraine.

Following documents are required to obtain tax number (RNOKPP / IPN) in case you will apply personally:

- Passport (original);

- Notarized translation of the passport into Ukrainian and a copy of such translation;

- Form № 1DR (English version of this form you can find here).

If you have a temporary residence permit, you must submit documents at the place of residence to the territorial bodies of the State Tax Service in districts, regions, districts of Kyiv and submit following documents:

- Temporary residence permit;

- Сopy of the temporary residence permit;

- Form № 1DR (translated version is attached to this article).

Foreigners and stateless persons can get tax number (RNOKPP) via personal visit or through a representative. In case you don’t want to visit tax authorities personally and waist your time in long lines and make mistakes in form 1DR, then you can authorise our lawyer by signing power of attorney.

Power of attorney can be signed in Ukraine or at your home country.

Total fee for the service that include all fees and costs is 100$.

In case you will sign a power of attorney we will ask you to cover notary expenses in the amount of 1000 UAH.

Form № 1DR – free English version – can be download here.